The foundation of any modern country’s economy depends on the successful conduction of foreign trade, and so, the number of laws surrounding such policy is unsurprising. However, while international trade is undeniably paramount for businesses which require supplies that are domestically unattainable, the United States’ current president, Donald J. Trump, declared earlier this year in January upon the commencement of his re-election that, “’Tariffs’ is the most beautiful word to me in the dictionary because tariffs are going to make us rich. It’s going to bring our country’s businesses back that left us.” From this point onwards, discourse surrounding upcoming tariffs targeting nearby countries such as Mexico and Canada became prevalent in virtually all political circles. However, it was not until February 1st that the first official tariffs were enacted on all imports from Mexico, Canada, and China. The administration even went so far as to declare the matter a “National Emergency,” prompted by undocumented immigration and drug trafficking. It only took the passing of another two days for a month long pause on all tariffs against Mexico and Canada to be officialized after both countries threatened to retaliate in response, which naturally brought up the possibility of a trade war between the United States and its former allies. Amidst all this federal discourse remains the average American citizen who must adapt to their country’s economic policies despite them seemingly not affecting their own lives. However, such a common misconception could not be further from the truth, for tariffs are ultimately something every adult citizen knows far too well through a multitude of forms.

A textbook definition of tariffs goes as follows, “A tariff is a tax imposed by one country on the goods and services imported from another country to influence it, raise revenues, or protect competitive advantages.” President Trump has already outlined the reason for which he imposed these tariffs: to protect competitive advantages, specifically those in favor of the United States. In the long-term, tariffs can indeed revolutionize systems and change them for the better, but, unfortunately, establishing an entirely new economic structure is not a fast process by any means, and for many Americans, time is just another privilege they cannot afford. In order for tariffs to work successfully, they must first raise the prices of foreign goods purchased by American consumers, but given just how many foreign goods the American government imports per year (which are accumulatively worth 4.1 trillion dollars), a plethora of businesses—both small and large—are bound to be severely impacted, leading to price increases on their end as well.

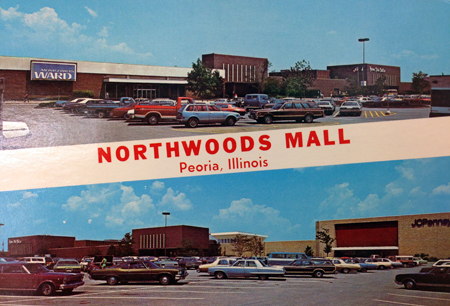

Small businesses are not entirely naive to the dangers of these newfound tariffs, either, and that fact is further ascertained by just how many small business owners have stepped forward on News channels to express their growing concern for the state of the American economy. One of those small business owners also just so happens to live in Peoria, and he got the chance to speak directly with Congressman Eric Sorenson regarding the effects tariffs will have on coffee shops such as his own, “Intuition Coffee + Juice.” When it comes to foreign grown commodities, tariffs are especially difficult to grapple with, and coffee, an American favorite, is undeniably one of them due to its near-exclusive production within areas south of North America. In response to the rising prices of supply, American businesses with even partial reliance on foreign goods will be forced to increase their prices, further impacting consumers and perpetuating an ongoing cycle of economic decline.

With the new tariff policy still being fully implemented, the American people must continue to prepare for the rising of commercial prices with the hopes that doing so shall eventually result in the betterment of our country’s economic stability.